NINEIDEA:工业设计早已不再是简单的“美化”产品,而是驱动商业成功的核心引擎。激烈的市场竞争和成熟的产业链,要求设计公司必须用更科学、更系统的方法来洞察市场与用户。成功的设计,始于精准的调研。以下是一套结合了深圳工业设计公司本地优势的“双轮驱动”调研体系:市场研究(宏观与商业视角) 与 设计调研(微观与用户视角)。

第一轮:市场研究——找准赛道与竞争壁垒

市场研究回答的是 “我们为谁设计,机会在哪里?” 的问题。它决定了设计方向的商业可行性。

1. 行业与趋势分析(看大势)

- 政策红利: 密切关注深圳市及大湾区发布的产业政策。例如,针对智能家居、新能源、大健康、高端装备制造等领域的扶持政策,意味着巨大的市场潜力和客户需求。

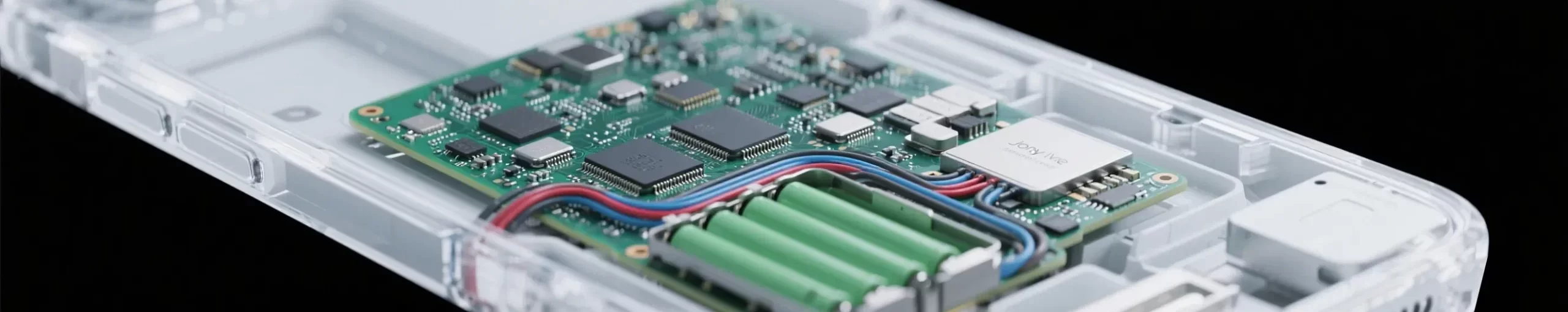

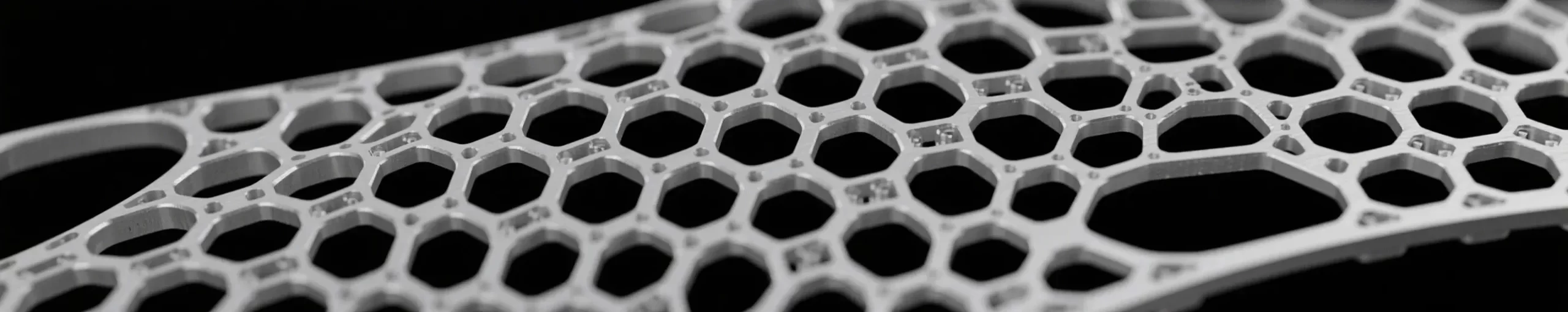

- 技术动向: 身处深圳,可以零距离感知技术迭代。通过参观光博会、高交会,与华强北的方案商交流,了解最新的芯片、传感器、材料与生产工艺,预判技术对产品形态和用户体验的影响。

- 社会文化与生活方式: 分析Z世代的消费观念、老龄化社会带来的银发经济、健康意识的觉醒等宏观社会趋势,从中发现新的产品机会点。

2. 竞争对手分析(知彼知己)

- 识别对手: 不仅包括直接竞品,还要关注跨界替代品和行业领导者。

- 分析维度:

- 产品矩阵: 对手有哪些产品线?价格区间如何?核心卖点是什么?

- 用户评价: 深度挖掘电商平台(京东、天猫国际)、社交媒体(小红书、抖音)上的用户好评与差评。差评是未被满足的需求,是绝佳的设计机会。

- 品牌定位与传播策略: 对手的品牌故事是什么?通过哪些渠道营销?这有助于找到差异化的定位。

- 产出物: 竞争格局图谱、SWOT分析表。

3. 目标用户群体界定(圈定用户)

- 用户画像: 基于市场数据,构建典型的用户画像。这不仅是人口统计学信息(年龄、收入、地域),更重要的是心理特征、行为习惯和价值观。例如:“注重效率的都市科技创业者”、“追求精致生活的宝妈”。

- 市场细分: 将广阔的市场划分为更小的、需求相似的细分市场,以便集中资源,精准打击。

第二轮:设计调研——深挖需求与体验痛点

设计调研回答的是 “用户真正需要什么,痛点是什么?” 的问题。它决定了设计方案的可用性与愉悦度。

1. 用户深访与情境访谈

- 方法: 不再是简单的问卷,而是深入到用户的使用场景(家中、办公室、户外)中进行一对一访谈。观察他们如何与现有产品互动,记录遇到的困难、不满足和“凑合”使用的瞬间。

- 深圳特色: 深圳拥有极其丰富和包容的用户群体,从高端白领到城中村的年轻人,可以轻易找到各类用户进行调研。利用本地社群(如车友会、户外俱乐部、母婴社群)招募受访者效率极高。

- 关键问题: “你为什么这么做?”“这个步骤让你感觉如何?”“如果有一个魔法可以解决一个问题,你希望是什么?”

2. 实地观察与影子跟随

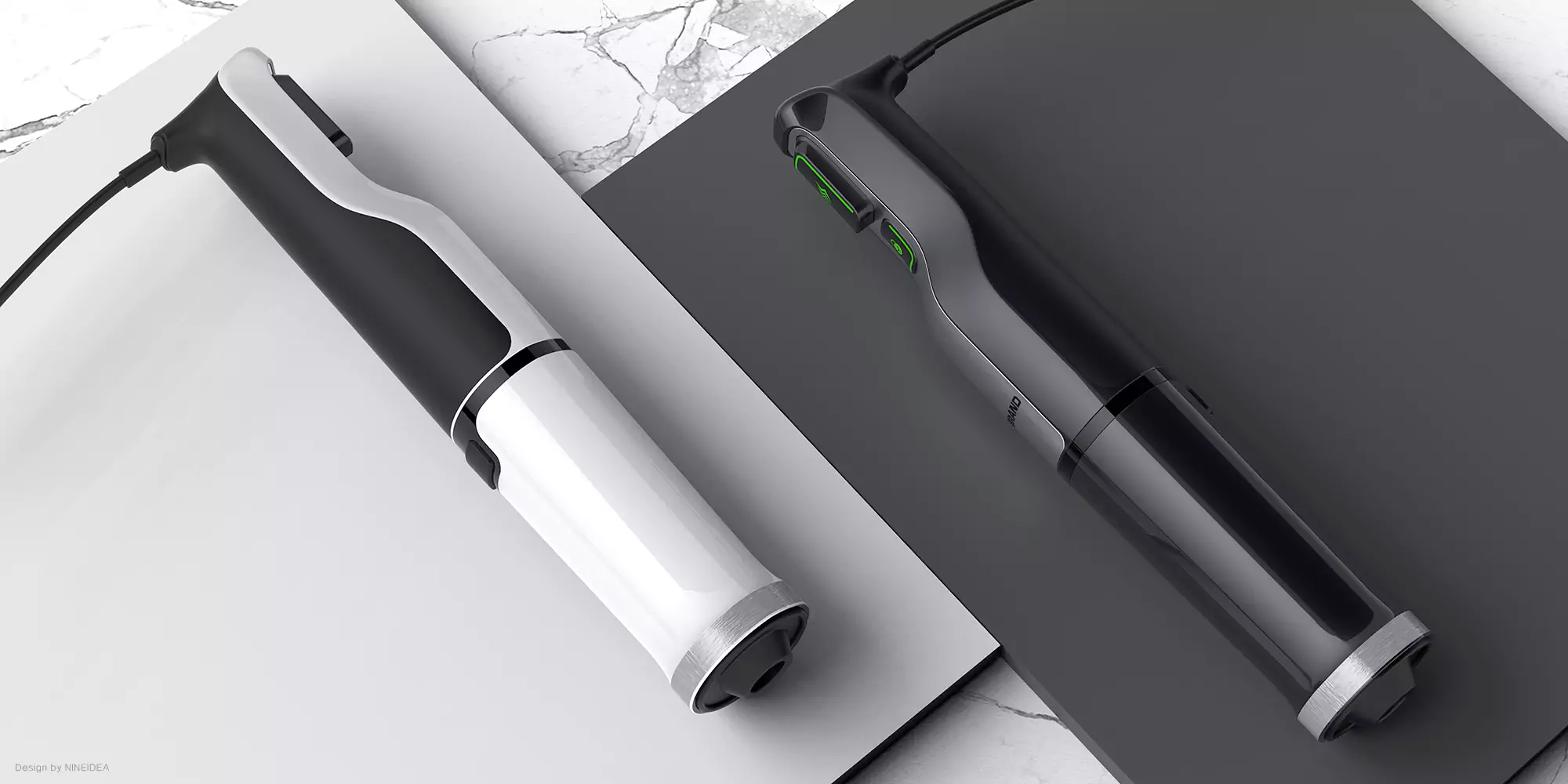

- 方法: 作为旁观者,像“影子”一样记录用户完成特定任务的全过程。例如,观察一名护士在ICU如何使用医疗设备,一名快递员如何分拣和使用手持终端。

- 价值: 用户说的和做的往往不一致。实地观察能发现那些“习以为常”以至于不会被主动提及的痛点。

3. 用户体验旅程图

- 方法: 将用户与产品/服务互动的全过程(从知晓、购买、开箱、使用、维护到废弃)可视化。在每一个触点上,标出用户的行动、想法、情绪曲线(波峰和波谷)以及痛点机会。

- 产出物: 一张清晰的旅程图,能帮助整个团队(设计、研发、市场)共识核心体验问题,并找到设计介入的关键节点。

4. 可用性测试(针对已有产品或原型)

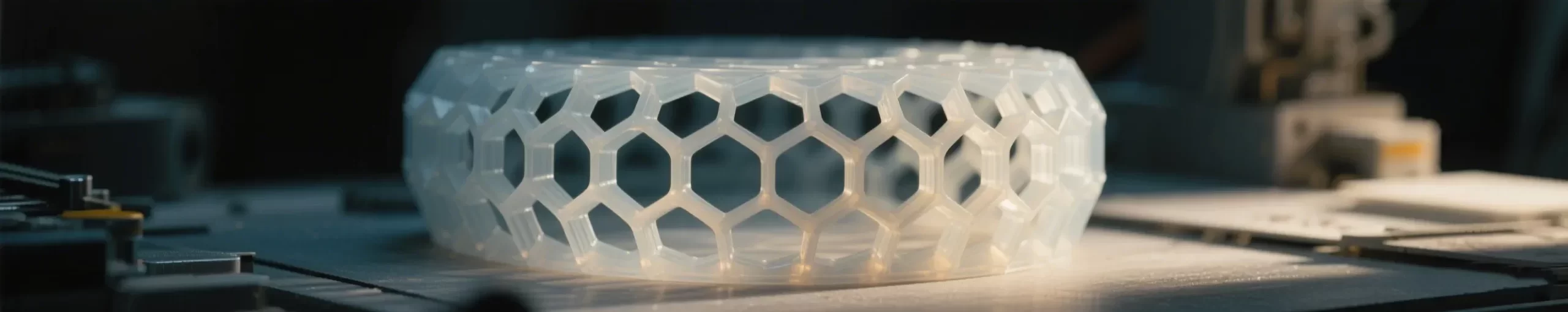

- 方法: 邀请目标用户操作产品原型(可以是草图、交互模型或3D打印模型),并执行关键任务。观察他们在哪里犹豫、出错或感到困惑。

- 深圳优势: 深圳强大的手板制作和电子原型开发能力,可以让设计公司在极短时间内制作出高保真原型进行测试,实现快速迭代。

融合与落地:从洞察到设计策略

调研的最终目的是指导设计。将市场研究和设计调研的发现进行融合,是至关重要的一步。

1. 洞察工作坊

- 组织跨职能团队(设计师、工程师、项目经理),将所有调研发现(用户语录、照片、视频、数据)贴在墙上。

- 使用亲和图法 对零散的发现进行归类、聚类,形成几个核心的“设计洞察”。

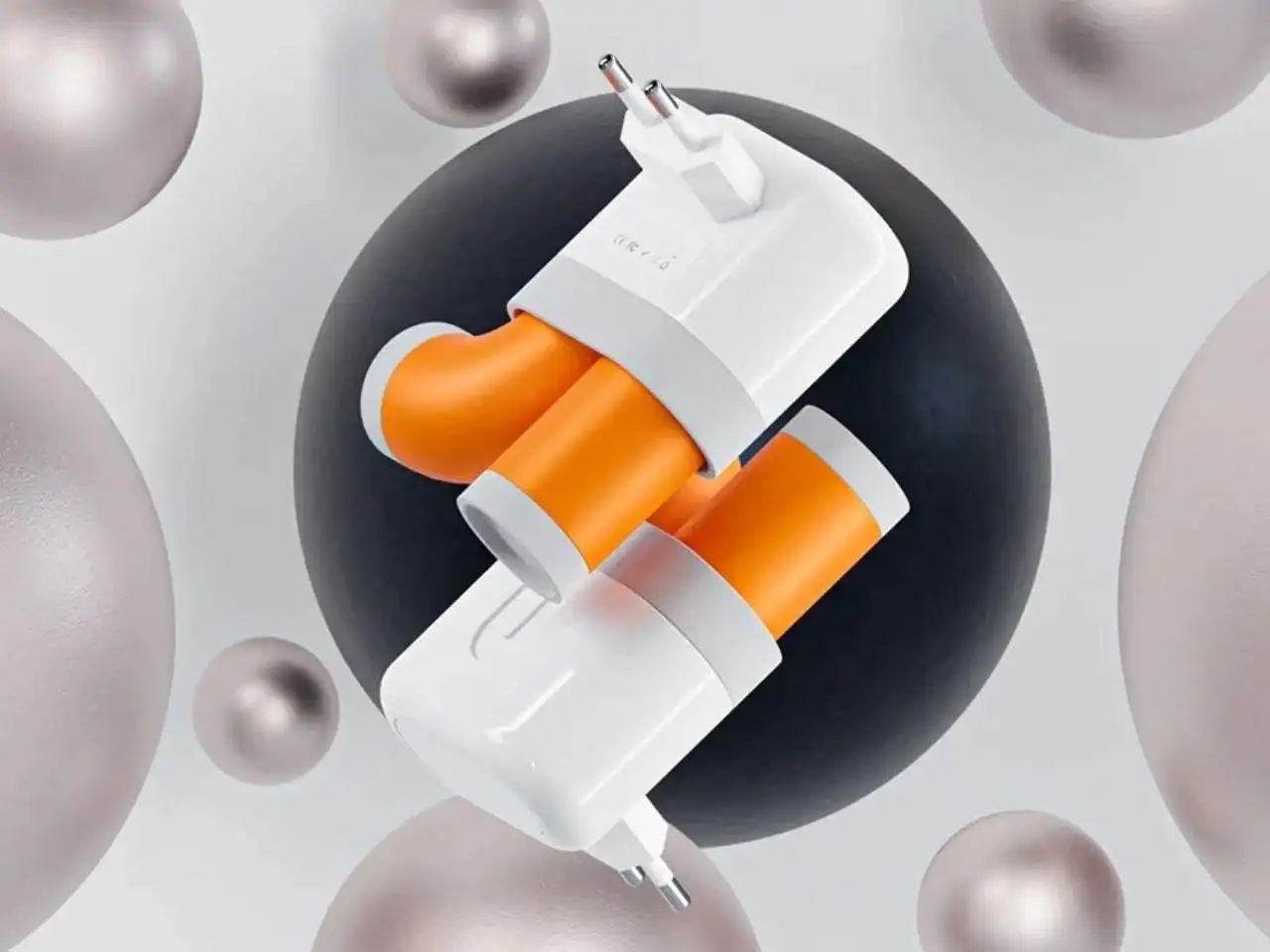

- 例如: 聚类“手机总没电”、“不爱带充电宝”、“办公室充电口不够”等发现,得出核心洞察:“都市通勤者在移动场景中存在强烈的‘电量焦虑’,需要更便捷、无缝的补电方案。” 这直接导向了共享充电宝、无线充电底座等产品概念。

2. 定义设计机会点

- 将核心洞察转化为“我们如何能够…”的问句。

- 例如: “我们如何能为通勤者提供一种无需携带、即用即走的充电体验?”

3. 形成设计策略与原则

- 基于机会点,制定指导后续具体设计的设计原则。

- 例如: “极致便捷”(磁吸吸附、无需线缆)、“场景融合”(可嵌入咖啡馆桌面)、“情感化设计”(拥有可爱造型,缓解焦虑情绪)。

结语

对于深圳的工业设计公司而言,凭借其得天独厚的产业生态和人才资源,完全有能力将市场研究与设计调研做到极致。这套“双轮驱动”的方法论,确保了设计不再是闭门造车的艺术创作,而是建立在坚实市场逻辑和深厚用户同理心之上的系统化创新过程。唯有如此,才能在与国内外同行的竞争中,持续为客户创造出兼具商业价值与用户体验的爆款产品,真正体现“深圳设计”的硬核实力。

@NINEIDEA九号创新 www.nineidea.com

一句话总结:市场研究决定了“做正确的事”,设计调研决定了“正确地做事”。两者结合,方能成就卓越设计。

Methodology for Market Research and Design Research of Shenzhen Industrial Design Company

Insight into the market and users through methods. Successful design begins with precise research. The following is a “dual wheel drive” research system that combines local advantages in Shenzhen: market research (macro and business perspectives) and design research (micro and user perspectives).

First round: Market research – finding the right track and competitive barriers

Market research answers the question of ‘Who are we designing for and where are the opportunities?’. It determines the commercial feasibility of the design direction.

- Industry and trend analysis (looking at the overall trend)

Policy dividend: closely monitor the industrial policies released by Shenzhen and the Greater Bay Area. For example, support policies for fields such as smart homes, new energy, big health, and high-end equipment manufacturing imply enormous market potential and customer demand.

Technology Trend: Being in Shenzhen, one can experience zero distance perception technology iteration. By visiting the Light Expo and High Tech Fair, and exchanging ideas with solution providers from Huaqiangbei, we can learn about the latest chips, sensors, materials, and production processes, and predict the impact of technology on product form and user experience.

Social Culture and Lifestyle: Analyze the consumption concepts of Generation Z, the silver haired economy brought about by an aging society, the awakening of health awareness, and other macro social trends to discover new product opportunities.

- Competitor analysis (know your opponent and know your friend)

Identifying competitors: This includes not only direct competitors, but also cross-border substitutes and industry leaders.

Analysis dimension:

Product Matrix: What product lines do competitors have? What is the price range? What are the core selling points?

User evaluation: in-depth mining of user’s favorable and negative comments on e-commerce platforms (JD, Tmall Global) and social media (Xiaohongshu, Tiktok). Negative reviews are unmet needs and excellent design opportunities.

Brand positioning and communication strategy: What is the competitor’s brand story? What channels are used for marketing? This helps to find differentiated positioning.

Output: Competitive landscape map, SWOT analysis table.

- Definition of target user group (delineation of users)

User Profile: Based on market data, construct a typical user profile. This is not only demographic information (age, income, region), but more importantly, psychological characteristics, behavioral habits, and values. For example, “urban technology entrepreneurs who prioritize efficiency” and “moms who pursue a refined lifestyle”.

Market segmentation: Divide the vast market into smaller, similarly demanding segments in order to concentrate resources and strike accurately.

Second round: Design research – delve deeper into the pain points of needs and experiences

The design survey answers the question of ‘What do users really need and what are their pain points?’. It determines the usability and enjoyment of the design scheme.

- User in-depth interviews and situational interviews

Method: It is no longer a simple questionnaire, but a one-on-one interview that delves into the user’s usage scenarios (home, office, outdoor). Observe how they interact with existing products, record the difficulties, dissatisfaction, and moments of “making do” with them.

Shenzhen characteristics: Shenzhen has an extremely rich and inclusive user base, ranging from high-end white-collar workers to young people in urban villages, who can easily find various types of users for research. The efficiency of recruiting respondents through local communities such as car clubs, outdoor clubs, and mother and baby communities is extremely high.

Key questions: “Why did you do this?” “How does this step make you feel?” “If there is a magic that can solve a problem, what would you like

- Field observation and shadow following

Method: As an observer, record the entire process of the user completing a specific task like a “shadow”. For example, observing how a nurse uses medical equipment in the ICU and how a courier sorts and uses handheld terminals.

Value: What users say and do often do not match. Field observation can reveal pain points that are so commonplace that they are not actively mentioned.

- User Experience Journey Map

Method: Visualize the entire process of user interaction with the product/service, from awareness, purchase, unboxing, use, maintenance to disposal. At each touchpoint, mark the user’s actions, thoughts, emotional curves (peaks and valleys), and pain point opportunities.

Output: A clear roadmap that can help the entire team (design, research and development, marketing) reach consensus on core experience issues and identify key nodes for design intervention.

- Usability testing (for existing products or prototypes)

Method: Invite target users to operate product prototypes (which can be sketches, interactive models, or 3D printed models) and perform critical tasks. Observe where they hesitate, make mistakes, or feel confused.

Shenzhen advantage: Shenzhen’s strong prototype production and electronic prototype development capabilities allow design companies to produce high fidelity prototypes for testing in a very short period of time, achieving rapid iteration.

Integration and Implementation: From Insight to Design Strategy

The ultimate goal of the research is to guide the design. Integrating the findings of market research and design research is a crucial step.

- Insight Workshop

Organize a cross functional team (designers, engineers, project managers) to post all research findings (user quotes, photos, videos, data) on the wall.

Use affinity graph method to classify and cluster scattered discoveries, forming several core “design insights”.

For example, clustering “phones always run out of battery”, “don’t like to bring power banks”, “insufficient office charging ports” and other findings lead to the core insight: “Urban commuters have strong ‘battery anxiety’ in mobile scenarios and need more convenient and seamless charging solutions.” This directly leads to product concepts such as shared power banks and wireless charging bases.

- Define design opportunity points

Translate the core insight into the question ‘How can we…’.

For example, “How can we provide commuters with a charging experience that doesn’t require carrying and can be used immediately

- Formulate design strategies and principles

Based on the opportunity points, develop design principles to guide subsequent specific designs.

For example, “ultimate convenience” (magnetic suction, no need for cables), “scene fusion” (can be embedded in coffee shop desktops), “emotional design” (has cute shapes, relieves anxiety).

Conclusion

For industrial design companies in Shenzhen, with their unique industrial ecology and talent resources, they are fully capable of conducting market research and design research to the extreme. This “two wheel drive” methodology ensures that design is no longer a closed door artistic creation, but a systematic innovation process built on solid market logic and deep user empathy. Only in this way can we continue to create explosive products that combine commercial value and user experience for customers in competition with domestic and foreign peers, truly reflecting the hardcore strength of “Shenzhen Design”.

In summary, market research determines’ doing the right thing ‘, while design research determines’ doing the right thing’. Only by combining the two can excellent design be achieved.