NINEIDEA:工业设计项目产品定位是确定产品在目标市场中独特价值和竞争优势的核心环节,直接影响后续设计方向、功能规划和用户体验。以下是系统化的产品定位步骤和方法,结合市场分析、用户需求和竞争环境展开:

一、前期准备:明确定位基础

1. 定义项目边界与目标

- 商业目标:明确产品是填补市场空白、升级现有产品,还是开拓新用户群体?例如:小米生态链产品常以 “高性价比智能硬件” 为核心目标。

- 企业资源匹配:评估自身技术(如供应链、研发能力)、预算和品牌调性。例如:戴森定位 “高端创新科技”,依赖其专利气流技术和设计溢价能力。

2. 市场宏观环境扫描

- 行业趋势:通过报告(如艾瑞咨询、Statista)分析行业规模、增长率、技术突破(如 2025 年可关注 AI 驱动设计、可持续材料、模块化产品)。

- 政策与社会因素:例如欧盟的环保法规(RoHS、WEEE)可能影响产品材料选择;中国 “双碳” 目标推动节能设计需求。

二、用户研究:挖掘真实需求

1. 用户细分与画像构建

- 分层维度:按 demographics(年龄、收入、地域)、psychographics(生活方式、价值观)、行为数据(使用场景、痛点)细分。

例:针对 “Z 世代” 设计耳机时,需关注便携性、社交分享功能(如耳机拍照弹窗),而非仅音质。 - 用户画像工具:创建典型用户角色(Persona),包含姓名、职业、痛点、使用场景。例如:

“通勤族小陈:每天 2 小时地铁,需要降噪功能,但讨厌入耳式耳机的胀痛感,预算 500-800 元。”

2. 需求深度挖掘

- 显性需求:通过问卷、访谈直接收集(如 “用户需要更轻便的吸尘器”)。

- 隐性需求:通过用户观察、场景模拟发现(如 “用户希望吸尘器能一键切换地毯 / 地板模式,避免手动调节的麻烦”)。

工具推荐:用户旅程图(User Journey Map)分析使用全流程痛点,KANO 模型区分必备型、期望型、魅力型需求。

三、竞争分析:寻找差异化机会

1. 竞品分类与拆解

- 直接竞品:功能、定位高度相似的产品(如苹果 AirPods vs 索尼 WF-1000XM)。

- 间接竞品:满足同一需求的不同形态产品(如传统电动牙刷 vs 声波电动牙刷 vs 冲牙器)。

- 拆解维度:功能配置、设计语言、价格区间、用户评价(重点分析差评高频词,如 “续航短”“操作复杂”)。

2. 差异化定位策略

- 功能差异化:聚焦竞品未覆盖的需求(如戴森卷发棒主打 “无高温损伤”,避开传统卷发器的核心痛点)。

- 体验差异化:优化使用流程(如小米手环的 “无感佩戴 + 磁吸充电” 降低用户学习成本)。

- 价值主张差异化:结合社会趋势(如 Patagonia 的 “环保户外装备”,吸引可持续消费群体)。

工具:SWOT 分析(自身优势 / 劣势 vs 外部机会 / 威胁)、定位矩阵(横轴:价格 / 纵轴:性能,标注竞品位置,寻找空白区间)。

四、确定核心定位要素

1. 明确目标市场

- 选择策略:

- 细分市场聚焦(如 Bose QuietComfort 系列专注 “商务降噪耳机”);

- 跨群体覆盖(如宜家产品兼顾 “性价比刚需” 与 “极简设计爱好者”)。

- 市场规模测算:通过 “目标用户数 × 渗透率 × 客单价” 评估商业可行性,避免定位过窄(如高端奢侈品需确保目标人群消费力足够)。

2. 定义价值主张

- 核心三问:

- 产品为用户解决什么问题?(例:扫地机器人解决 “家庭清洁耗时” 问题);

- 与竞品相比,独特优势是什么?(例:Roomba 的 “智能路径规划” vs 竞品的 “随机碰撞”);

- 用户为什么愿意为此买单?(例:戴森的 “技术溢价” vs 小米的 “性价比”)。

- 价值主张公式:

“为【目标用户】提供【产品功能 / 体验】,从而实现【用户收益】,相比【竞品】,我们的优势是【差异化点】。”

例:“为注重健康的都市白领设计智能水杯,通过自动提醒饮水 + 水质监测,帮助他们养成科学饮水习惯,相比传统水杯,我们的优势是‘无感连接 APP + 长效续航’。”

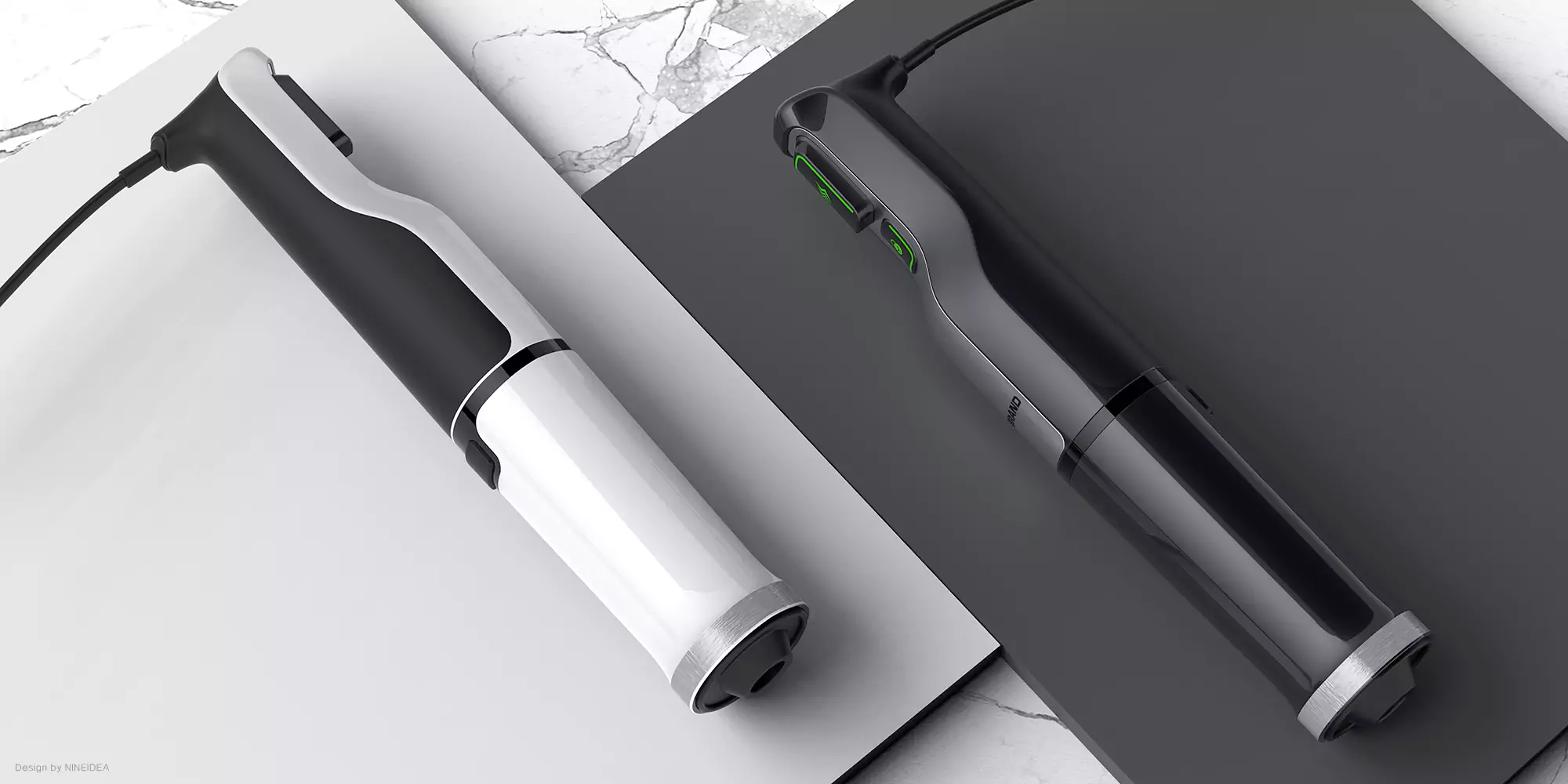

3. 设计语言与品牌调性匹配

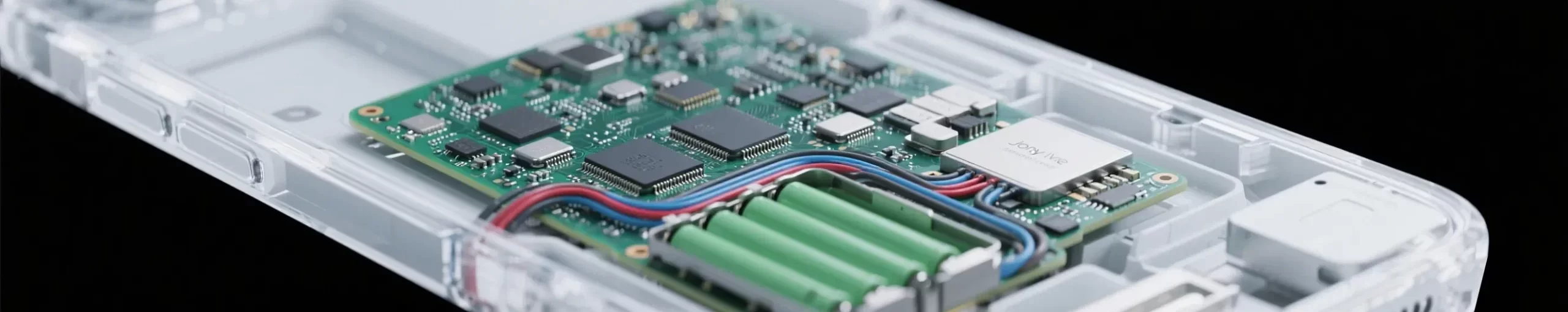

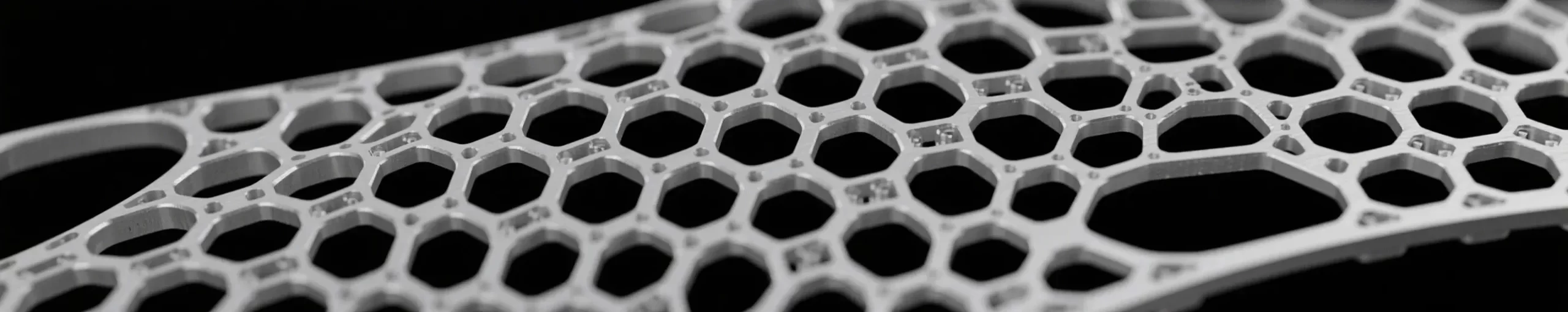

- 视觉定位:确定产品的形态(圆润 vs 硬朗)、色彩(高端用黑 / 银,年轻化用亮色)、材质(金属显质感,塑料控成本)。

- 体验定位:操作逻辑(极简按键 vs 触屏交互)、情感化设计(如 OXO 厨具的 “无障碍握把” 传递人文关怀)。

五、验证与迭代定位

1. 原型测试与用户反馈

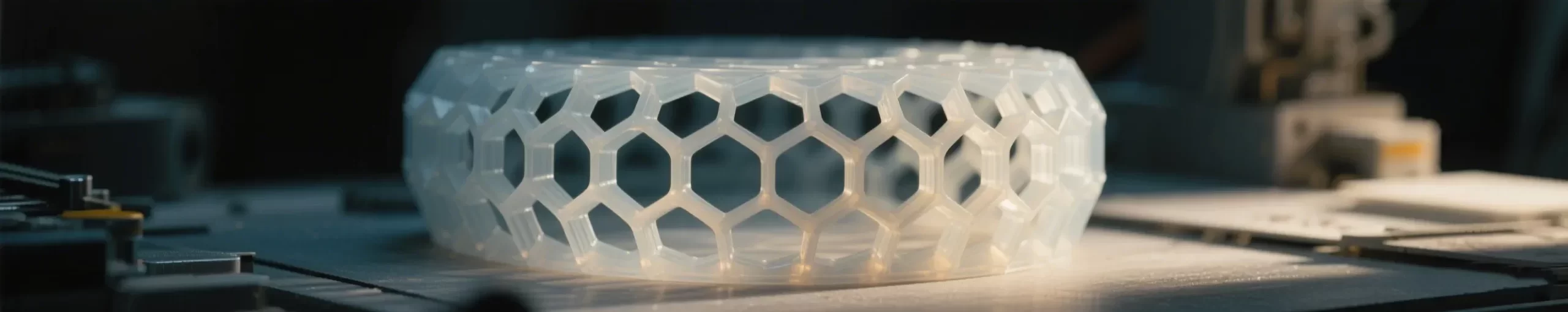

- 制作低保真原型(如 3D 打印模型、交互 Demo),邀请目标用户体验,重点收集:

- “是否解决了你的主要需求?”

- “相比现有产品,你更愿意选择它的原因是?”

- “有哪些功能让你觉得多余 / 不足?”

2. 市场试点与数据监测

- 小批量投产或通过众筹平台(如 Kickstarter)测试市场反应,关注指标:

- 预购转化率、用户评论、复购意向;

- 若数据未达预期,回溯定位环节(如是否目标用户错配、差异化点不突出)。

3. 动态调整定位

- 应对市场变化(如竞品突然降价、政策调整),灵活优化定位。例如:

2023 年某品牌电动滑板车原定位 “高端通勤”,但因城市限行政策,调整为 “短途娱乐 + 便携折叠”,主打景区租赁市场。

六、案例参考:智能手表定位拆解

- 苹果 Watch:定位 “健康管理 + iPhone 生态延伸”,核心用户为 iOS 深度用户,差异化在 “ECG 心电图 + 摔倒检测”,价格高端(3000 + 元)。

- 小米手环:定位 “轻量化健康监测 + 高性价比”,目标用户为学生 / 健身入门者,优势在 “14 天续航 + 百元价格”,设计语言简约百搭。

- Garmin Fenix:定位 “专业户外运动手表”,聚焦极限运动者,差异化在 “军工级续航 + 精准 GPS + 多运动模式”,价格昂贵(8000 + 元)。

总结:产品定位核心逻辑

产品定位 =(用户需求-市场机会-企业能力)可行性 +(差异化价值-竞品同质化)竞争力

通过系统化的用户洞察、竞争分析和动态验证,工业设计项目可精准锚定目标,避免 “为设计而设计”,最终实现商业价值与用户体验的平衡。在快速变化的市场中,定位并非一次性决策,需结合反馈持续迭代,尤其关注技术突破(如 AI、新材料)和社会趋势(如老龄化、可持续)带来的新机会。

Industrial Design Project Product Positioning Full Process Guide: From User Insights to Differentiated Implementation

NINEIDEA:The product positioning of industrial design projects is the core link in determining the unique value and competitive advantage of the product in the target market, which directly affects the subsequent design direction, functional planning, and user experience. The following are systematic steps and methods for product positioning, combined with market analysis, user needs, and competitive environment:

1、 Preparation in advance: Clarify the positioning foundation

- Define project boundaries and objectives

Business objective: Is the product intended to fill market gaps, upgrade existing products, or expand into new user groups? For example, Xiaomi’s ecosystem products often have the core goal of “high cost-effective smart hardware”.

Enterprise resource matching: Evaluate one’s own technology (such as supply chain, research and development capabilities), budget, and brand tone. For example, Dyson positions itself as a “high-end innovative technology” that relies on its patented airflow technology and design premium capabilities.

- Scanning of the macro market environment

Industry Trends: Analyze industry size, growth rate, and technological breakthroughs through reports such as iResearch and Statista (such as focusing on AI driven design, sustainable materials, and modular products by 2025).

Policy and social factors: for example, EU environmental regulations (RoHS, WEEE) may affect product material selection; China’s “dual carbon” goals drive the demand for energy-efficient design.

2、 User Research: Digging into Real Needs

- User segmentation and portrait construction

Hierarchical dimensions: subdivided by demographics (age, income, region), psychographies (lifestyle, values), and behavioral data (usage scenarios, pain points).

Example: When designing headphones for Generation Z, attention should be paid to portability and social sharing features (such as headphone photo pop ups), rather than just sound quality.

User profiling tool: Create a typical user persona, including name, occupation, pain points, and usage scenarios. For example:

Commuter Xiao Chen: I take the subway for 2 hours a day and need noise reduction function, but I hate the swelling and pain of in ear headphones. My budget is 500-800 yuan

- Deep mining of requirements

Explicit demand: collected directly through questionnaires and interviews (such as’ users need lighter vacuum cleaners’).

Implicit demand: discovered through user observation and scene simulation (such as “users hope that the vacuum cleaner can switch carpet/floor modes with one click to avoid the trouble of manual adjustment”).

Tool recommendation: Use the User Journey Map to analyze pain points throughout the entire process, and use the KANO model to distinguish between essential, expected, and attractive requirements.

3、 Competitive analysis: seeking differentiation opportunities

- Classification and disassembly of competitors

Direct competitors: products with highly similar functions and positioning (such as Apple AirPods vs Sony WF-1000XM).

Indirect competitors: products in different forms that meet the same demand (such as traditional electric toothbrushes vs sonic electric toothbrushes vs dental irrigators).

Decomposition dimensions: functional configuration, design language, price range, user evaluation (with a focus on analyzing high-frequency negative words such as “short battery life” and “complex operation”).

- Differentiated positioning strategy

Functional differentiation: Focus on needs not covered by competitors (such as the Dyson curling iron’s emphasis on “no high temperature damage”, avoiding the core pain points of traditional curling irons).

Experience differentiation: optimize the usage process (such as Xiaomi’s “contactless wearing+magnetic charging” to reduce user learning costs).

Value proposition differentiation: Combining social trends (such as Patagonia ‘”environmentally friendly outdoor equipment” to attract sustainable consumer groups).

Tools: SWOT analysis (self strengths/weaknesses vs external opportunities/threats), positioning matrix (horizontal axis: price/vertical axis: performance, mark competitor positions, find blank intervals).

4、 Determine the core positioning elements

- Clarify the target market

Selection strategy:

Segmented market focus (such as Bose QuietComfort series focusing on “business noise cancelling headphones”);

Cross group coverage (such as IKEA products balancing “cost-effectiveness and essential needs” with “minimalist design enthusiasts”).

Market size calculation: Evaluate commercial feasibility through “target user number x penetration rate x unit price” to avoid narrow positioning (such as ensuring sufficient consumer power for high-end luxury goods).

- Define value proposition

Core three questions:

What problems does the product solve for users? (Example: Robotic vacuum cleaners solve the problem of “time-consuming household cleaning”);

What are the unique advantages compared to competitors? (Example: Roomba’s “Intelligent Path Planning” vs Competitors’ “Random Collision”);

Why are users willing to pay for this? (Example: Dyson’s “technology premium” vs Xiaomi’s “cost-effectiveness”).

Value proposition formula:

To provide [product features/experiences] to [target users] and achieve [user benefits], our advantage over [competitors] is [differentiation points]

For urban white-collar workers who value their health, we have designed smart water bottles that automatically remind them to drink water and monitor water quality to help them develop scientific drinking habits. Compared to traditional water bottles, our advantage is the ‘seamless connection app+long-lasting battery life’. ”

- Matching design language with brand tone

Visual positioning: Determine the shape of the product (rounded vs. tough), color (high-end use black/silver, youthful use bright colors), and material (metallic texture, plastic cost control).

Experience positioning: operation logic (minimalist button vs touch screen interaction), emotional design (such as the “barrier free grip” of OXO kitchenware conveying humanistic care).

5、 Verification and iterative positioning

- Prototype testing and user feedback

Create low fidelity prototypes (such as 3D printed models, interactive demos), invite target users to experience, and focus on collecting:

Has your primary need been addressed

What is the reason why you are more willing to choose it compared to existing products

What functions do you feel are redundant/insufficient

- Market pilot and data monitoring

Small batch production or market response testing through crowdfunding platforms such as Kickstarter, focus on metrics:

Pre order conversion rate, user reviews, and intention to repurchase;

If the data does not meet expectations, backtrack the localization process (such as whether the target user is mismatched or if the differentiation points are not prominent).

- Dynamically adjust positioning

Adapt to market changes (such as sudden price reductions of competitors, policy adjustments) and flexibly optimize positioning. For example:

In 2023, a certain brand of electric scooter was originally positioned as “high-end commuting”, but due to urban traffic restrictions, it has been adjusted to “short distance entertainment+portable folding”, focusing on the rental market of scenic spots.

6、 Case reference: Disassembly of smartwatch positioning

Apple Watch: Positioned as a “health management+iPhone ecosystem extension”, core users are iOS deep users, differentiated in “ECG electrocardiogram+fall detection”, with a high-end price (3000+yuan).

Xiaomi Band: Positioned as “lightweight health monitoring+high cost-effectiveness”, targeting students/fitness beginners, with the advantage of “14 day battery life+100 yuan price”, the design language is simple and versatile.

Garmin Fenix: Positioned as a “professional outdoor sports watch”, focusing on extreme sports enthusiasts, differentiated in “military grade endurance+precise GPS+multi sport mode”, expensive (8000+yuan).

Summary: Core Logic of Product Positioning

Product positioning=(user demand – market opportunity – enterprise capability) feasibility+(differentiation value – competitor homogenization) competitiveness

Through systematic user insights, competitive analysis, and dynamic verification, industrial design projects can accurately anchor goals, avoid “designing for design’s sake”, and ultimately achieve a balance between business value and user experience. In a rapidly changing market, positioning is not a one-time decision, it needs to be continuously iterated with feedback, especially focusing on new opportunities brought by technological breakthroughs (such as AI, new materials) and social trends (such as aging, sustainability).